An Independent Firm Focused On Families & Companies in Growth Sectors of the Economy

Industry Experience

Without Conflict

Business Services, Consumer, Healthcare, Industrial Manufacturing, Leisure & Entertainment, Real Estate, Technology/Media/Telecom

A Focus On Founders,

Families & Corporations

Over the years we have advised some of the finest family-owned businesses as well as publicly and privately held corporations worldwide.

National & Cross

Border Reach

Genesis Capital has clients across the US and numerous countries around the globe providing additional relationships and expertise with international operations and acquirers.

Industry Experience

Without Conflict

Business Services, Consumer, Healthcare, Industrial Manufacturing, Leisure & Entertainment, Real Estate, Technology/Media/Telecom

A Focus On Founders,

Families & Corporations

Over the years we have advised some of the finest family-owned businesses as well as publicly and privately held corporations worldwide.

National & Cross

Border Reach

Genesis Capital has clients across the US and numerous countries around the globe providing additional relationships and expertise with international operations and acquirers.

Please contact us to learn more.

Please contact us to learn more.

Select Success Stories

From family offices to corporate boardrooms, Genesis Capital is privileged to serve and work with leading companies to achieve their most important goals and objectives.

Business Description: Leading operator and franchisor of quick-service restaurants (QSR).

Company Type and Location: Public (NASDAQ: PLKI); Atlanta, GA

Our Involvement and Result: Advised the Company on its sale to Restaurant Brands International, Inc. (NYSE/TSX:QSR), a 3G Capital portfolio company, and parent company of Burger King & Tim Hortons. >

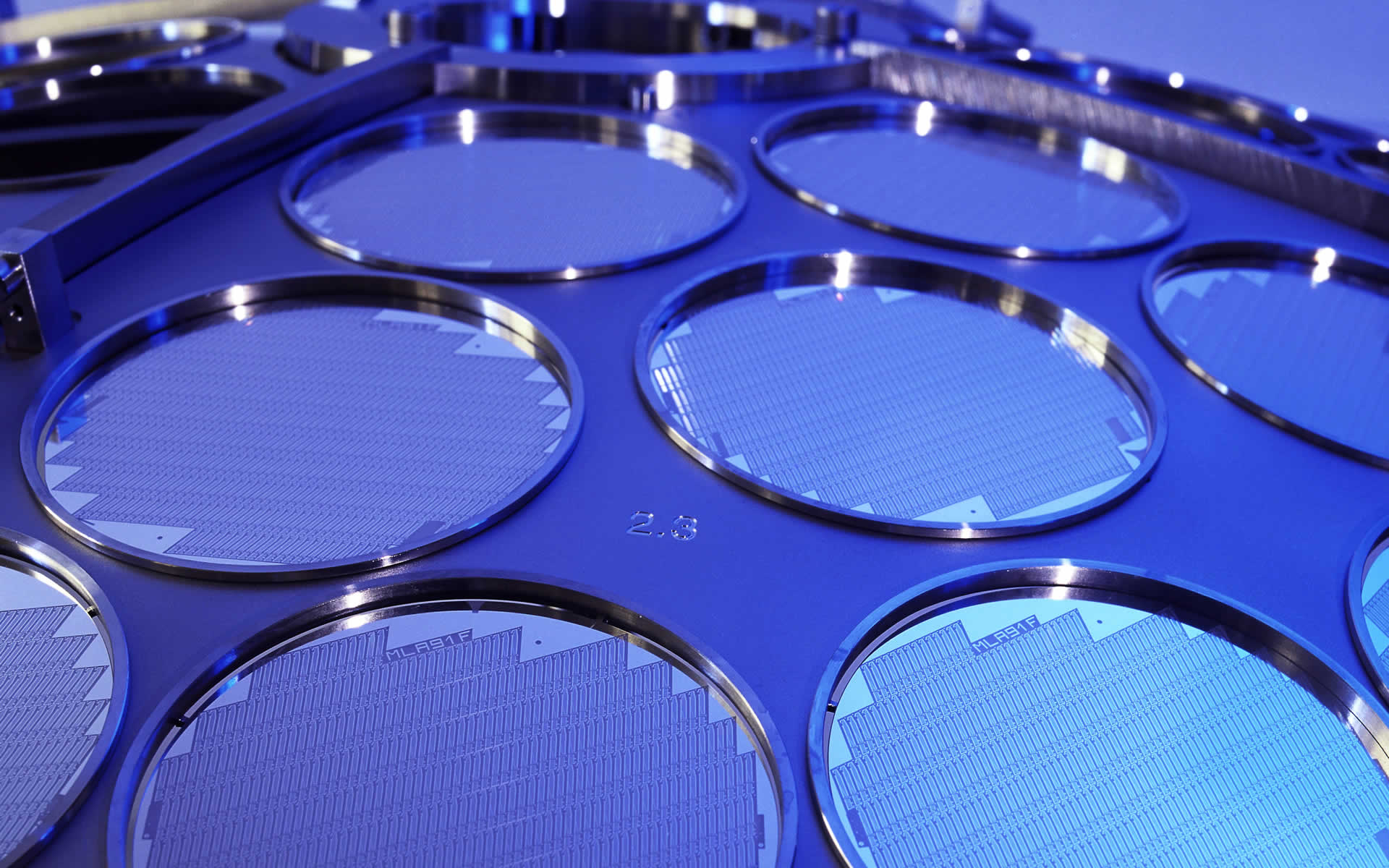

Business Description: Largest U.S.-based provider of silicon wafer reclaim services, specialty thin film deposition products, and silicon parts services.

Company Type and Location: Private; San Jose, CA

Our Involvement and Result: Evaluation of strategic alternatives resulting in sale to Edgewater Capital Partners. >

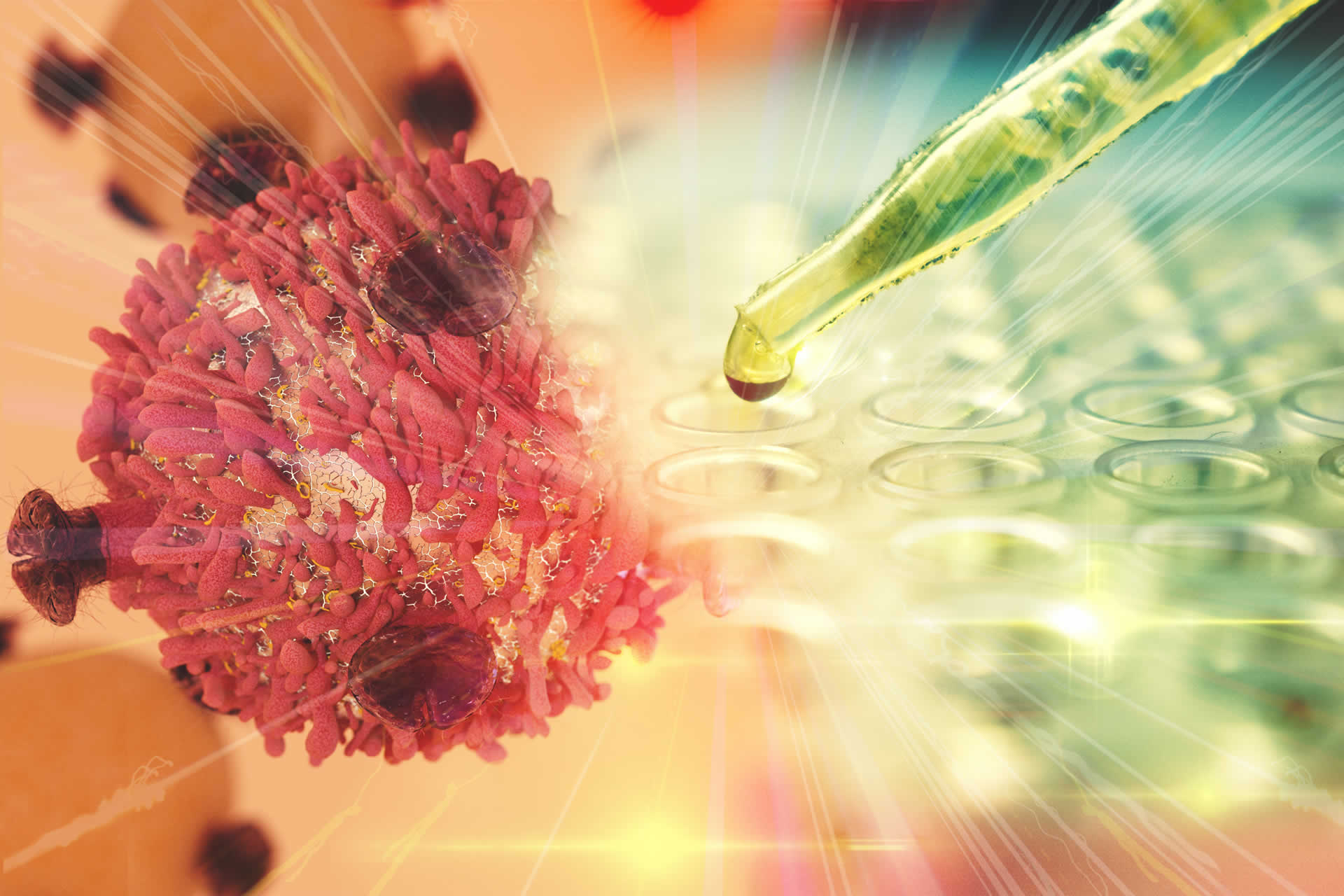

Business Description: Leading global provider of independent medical education for oncology and hematology healthcare professionals.

Company Type and Location: Private; Global

Our Involvement and Result: Evaluation of strategic alternatives resulting in sale to WebMD Health Corp., an Internet Brands company. >

Business Description: Leading manufacturer of specialty polymers including: polyurethane elastomers and casting resins, silicones, epoxies, and latex.

Company Type and Location: Private; Easton, PA

Our Involvement and Result: Execution of buyside M&A strategy resulting in the acquisitions of California Medical Innovations, Alumilite Corporation, Raw Material Suppliers, and BCC Products. >

Business Description: Consumer products company and leading supplier of residential locksets, shaving and grooming products, personal care products, small household appliances, specialty pet supplies, lawn and garden, home pest control products, and personal insect repellent.

Company Type and Location: Public (NYSE:SPB)

Our Involvement and Result: Execution of buyside M&A strategy resulting in the acquisitions of Black Flag, EnviroHold, Liquid Fence and TAT. >

Business Description: Leading provider of specialized workforce solutions.

Company Type and Location: Public (NYSE:TBI); Tacoma, WA

Our Involvement and Result: Evaluation of strategic alternatives resulting in divestiture of PlaneTechs, LLC to LAUNCH Technical Workforce Solutions. >

Business Description: Orthopedic-focused health system with a reputation for clinical excellence, providing orthopedic, musculoskeletal and related healthcare services.

Company Type and Location: Private; Savannah, GA

Our Involvement and Result: Evaluation of strategic alternatives resulting in sale to National Surgical Healthcare. >

Business Description: Manufacturer and distributor of treated outdoor wood products for the commercial, industrial, and utility markets.

Company Type and Location: Family-owned; Orangeburg, SC

Our Involvement and Result: Evaluation of strategic alternatives resulting in the divestiture of its Residential Lumber Division to Culpeper Wood Preservers and the sale of its Industrial division to Koppers, Inc. (NYSE:KOP). >

Business Description: Portfolio of entertainment venues in the Southeast.

Company Type and Location: Non-Profit; Atlanta, GA

Our Involvement and Result: Evaluation of strategic alternatives resulting in long term agreement with Live Nation Entertainment, Inc. (NYSE:LYV). >

Business Description: Nation’s largest family-owned themed attractions corporation that operates entertainment, tourism and hospitality properties spanning 23 locations in six states.

Company Type and Location: Family-owned; Atlanta, GA

Our Involvement and Result: Execution of a over ten-year buyside M&A strategy resulting in numerous acquisitions, including the Adventure Aquarium, the Harlem Globetrotters, Newport Aquarium, and Wild Adventures Theme Park. >